wealth Management Pvt. Ltd.

Vipulanchal is a financial services firm engaged in offering a wide range of financial products and services such as stock broking, Demat and trading accounts, mutual funds, IPO investments, insurance, direct equity investment, medical claim insurance, online PAN card services, income tax return services, and more.

At Vipulanchal, we believe that protecting your funds is a prime responsibility, which requires deep knowledge and careful planning.

Our main aim is to understand our clients’ needs by designing flexible products that meet their requirements, processing loans efficiently, offering financial solutions that enhance their income or improve their lives, and providing inclusive financing by working in underserved areas. To achieve this, we follow a four-step process of financial planning: Risk Profiling, Goal Planning, Portfolio Structuring, and Portfolio Tracking.

Physical Shares are those shares which are held in physical certificates by the Investors. Demat is an electronic form of preserving shares; that is paperless trading.

.jpg)

Direct equity investment can be very rewarding. Simultaneously this is also true that risk of loss in direct equity is high.

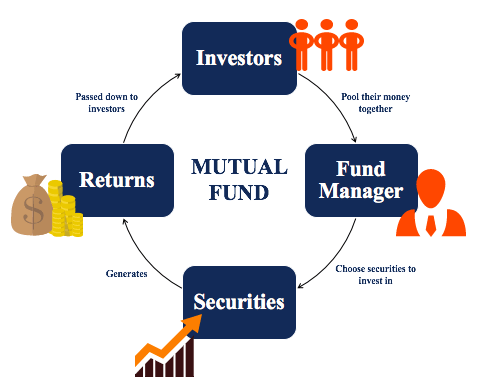

Mutual funds are ideal for investors who want to invest in various kinds of schemes with different investment objectives but do not have sufficient time and expertise to pick winning stocks.

A Demat Account or Dematerialised Account provides the facility of holding shares and securities in an electronic format.

The process of Initial Public Offering (IPO) transforms a privately-held company into a public company.

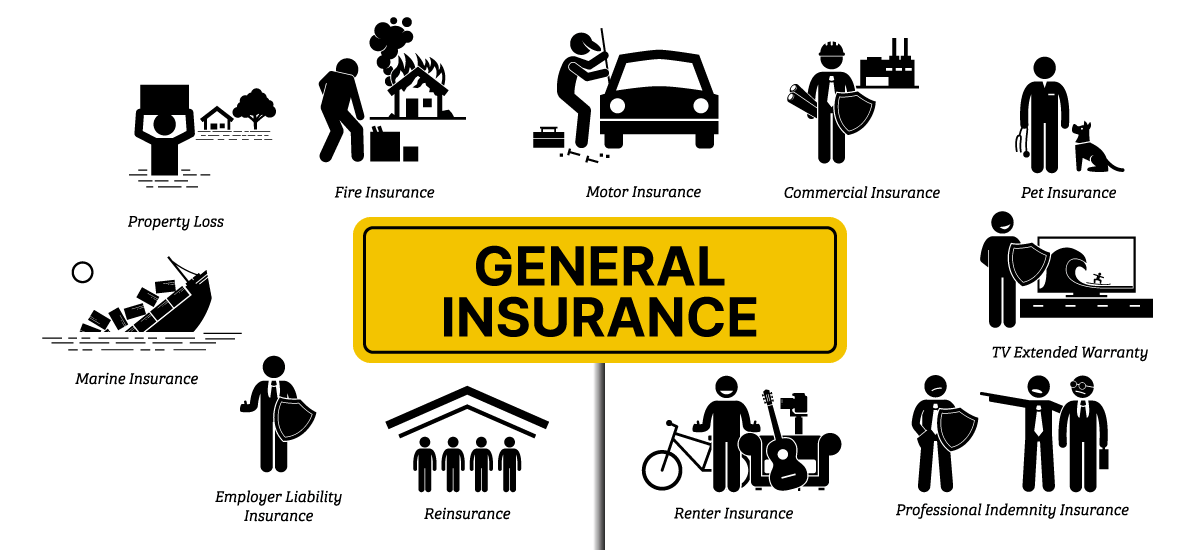

A General insurance policy is a non-life insurance product that includes a range of general insurance policies.

A health insurance policy is a contract between the insurer and policyholder in which insurance company provides financial coverage for medical expenses incurred by the insured.

Lot of changes are made in Income Tax each year which affect your tax return. Filing correct income tax return is very important to safe yourself from unwanted tax notice.

Application for fresh allotment of PAN can be made through Internet. Further, requests for changes or correction in PAN data or request for reprint of PAN card (for an existing PAN) may also be made through Internet.

.jpg)

Applying for a passport can be done online by visiting the official Passport Seva website.

Gold as an investment is respected throughout the world for its value and rich history. The reasons people tend to make a gold investment are also different, it can be viewed as an asset which helps creating wealth as well as used to control and hedge financial market risks and rising inflation. Being one of the most preferred asset class in India, investment in digital gold is considered to be one of the best performing asset and provide good returns in coming future.

| | |||

Bhim UPI Number: | 97139 59050 |